The US and Europe are both on the brink of a short minor recession in 2024, as green shoots of a tentative recovery are seen elsewhere in the global manufacturing economy.

The US and Europe are both on the brink of a short minor recession in 2024, as green shoots of a tentative recovery are seen elsewhere in the global manufacturing economy.

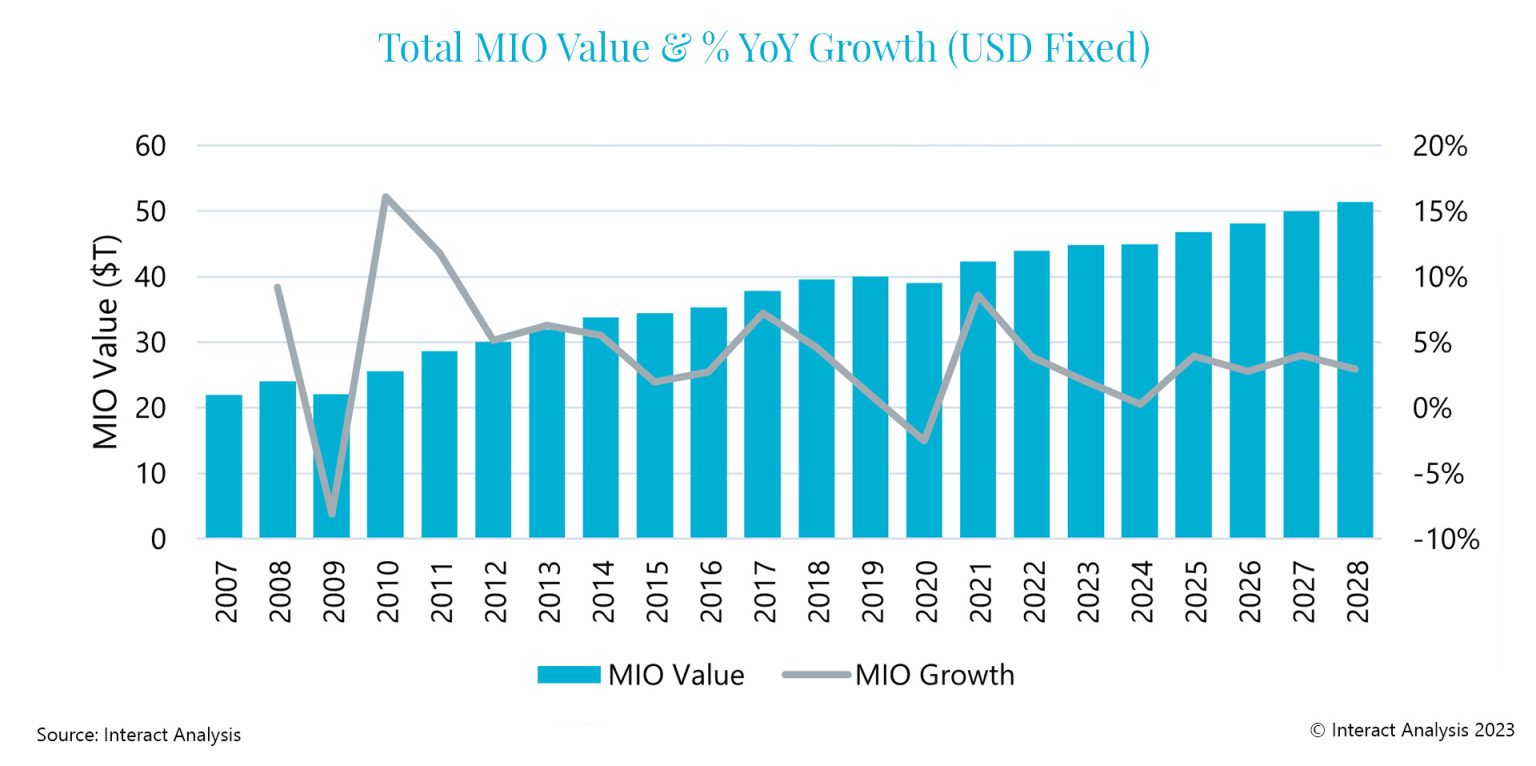

Stability is returning to some parts of the world, with the manufacturing economy on the brink of recovery in 2025 if the right fiscal choices are made, according to the latest version of the Interact Analysis Manufacturing Industry Output (MIO) Tracker.

Our forecasts have changed little since the last update and it is looking as though there will be a rough 2024 for many regions, including the Americas and Europe, moving into a better 2025. The predicted recession is not likely to be sharp and should end relatively swiftly, so long as governments implement the right policies to stimulate growth without creating runaway inflation.

Since our last quarterly projections, we have slightly increased how negative 2024 is forecast to be and reduced expectations around recovery in 2025 as there is some concern that 2024’s dip could continue into the early part of 2025.

A slight dip is anticipated in global manufacturing industry output in 2024, with an uptick forecast in 2025

Although China’s forecast for 2023 has been revised slightly downward to 3.2%, it is expected to continue recovering from a slow start at the beginning of the year. As China shows signs that stimulus policies are having an effect, the forecasted growth for 2024 has been adjusted up slightly from 2.9% to 3.0%. This will help to prop up global manufacturing, which is heavily biased by China, and would otherwise show a -1.8% contraction – rather than 0.3% growth – if China was excluded from the forecast data.

At Interact Analysis, we will be closely watching the impact of policies such as interest rates and stimulus initiatives on global economies and their manufacturing sectors, with the risk of stagflation or stifled demand very real.

In this edition we have extended our MIO forecasts out to 2028 and added Singapore to cover a total of 45 countries, across 72 manufacturing end user sectors, 30 machinery sectors and two points in the supply chain (machinery and manufacturing end-users), so the latest forecasts cover more than ever before.

Could the global malaise stick?

Our overall expectations for manufacturing industry output have been revised down slightly from the last quarter as there is clear evidence of a global malaise. However, it remains to be seen whether or not this is endemic. All the signs currently point to a slight recession in 2024, with markets returning to growth the following year.

Europe is still struggling with predicted contractions or very slight growth in all its largest countries during 2023, which has also led us to cut forecasts for the region by a further half a percent. In most cases, automotive sectors have performed strongly, but this has not been enough to offset poor performance in other industries, such as chemicals & pharmaceuticals, and textile machinery. France (-1.3%) and Germany (-1.4%) are expected to see total MIO growth in negative figures during 2024, following slight increases in 2023, while the UK, having performed poorly in 2023 with forecast growth of only 0.21%, is expected to see minimal recovery from the upcoming manufacturing recession.

Meanwhile, following a strong start to the year, US GDP grew by an annualized rate of close to 5% (4.9%) in Q3, but the impact of this on manufacturing output has yet to be seen. We are currently on ‘Fed Watch’, as the Federal Reserve’s reaction is likely to dictate how hard or soft a landing the US gets. If interest rates are cut too fast, the risk of inflationary pressures returns, and even stagflation, which would signal a longer period of poor performance. If interest rates fall too slowly, demand will be constrained and hit the manufacturing industry as well as the wider economy.

A strong performance from automotive and outlook brightening for semiconductors & components

There are some bright spots in the MIO forecast, with the automotive industry outperforming other sectors. Having struggled to recover post-pandemic, it has been due a bounce-back for some time. Indeed, the on-highway industry in the Americas region is predicted to have a staggering growth rate of 15.4% this year.

Meanwhile, while the semiconductor & components industry has struggled in recent months, we are anticipating a bounce back in 2024 as over-stock issues wane. This slump is largely a result of the unsustainably strong performance from the sector in recent years and the inevitability that there would be a market correction at some point, although we now do not think the drop during 2023 will be as sharp as initially feared.

So, what do we expect for the coming year?

There is evidence of a global malaise, and it is to be hoped this is not endemic in some regions. China is doing its best with stimulus policies to come out of its slump, and this seems to be working. However, the US appears to be on the brink of a recession, which is likely to be relatively mild, but could be stretched depending on the government’s response. With some regions, economically it could be death by 1,000 cuts rather than a short sharp shock, although with reasonable fiscal management we predict most countries will start to recover in 2025.

We have reduced the total MIO outlook by around half a percent across the board for 2023 to reflect the difficulties plaguing the manufacturing economy, and it is a concern that some of these issues may stick around for some time. However, with the right fiscal policies and the wind in our favor, the global manufacturing economy will show signs of a steady recovery from 2025.

www.interactanalysis.com